food tax calculator pa

By Jennifer Dunn August 24 2020. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

Just enter the wages tax withholdings and other information required.

. Before-tax price sale tax rate and final or after-tax price. In the US each state makes their own rules and laws about what products are. The Pennsylvania sales tax rate is 6 percent.

Total rate range 6080. Our calculator has recently been updated to include both the latest Federal. Resources Blog Food.

SmartAssets Pennsylvania paycheck calculator shows your hourly and salary income after federal state and local taxes. Once that earning amount surpasses 200000 the rate is. The Pennsylvania food stamp calculator is a tool that can help you determine if you qualify for food stamps in the state.

Step One - Calculate Total Tax Due. Your average tax rate is 1198 and your. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax.

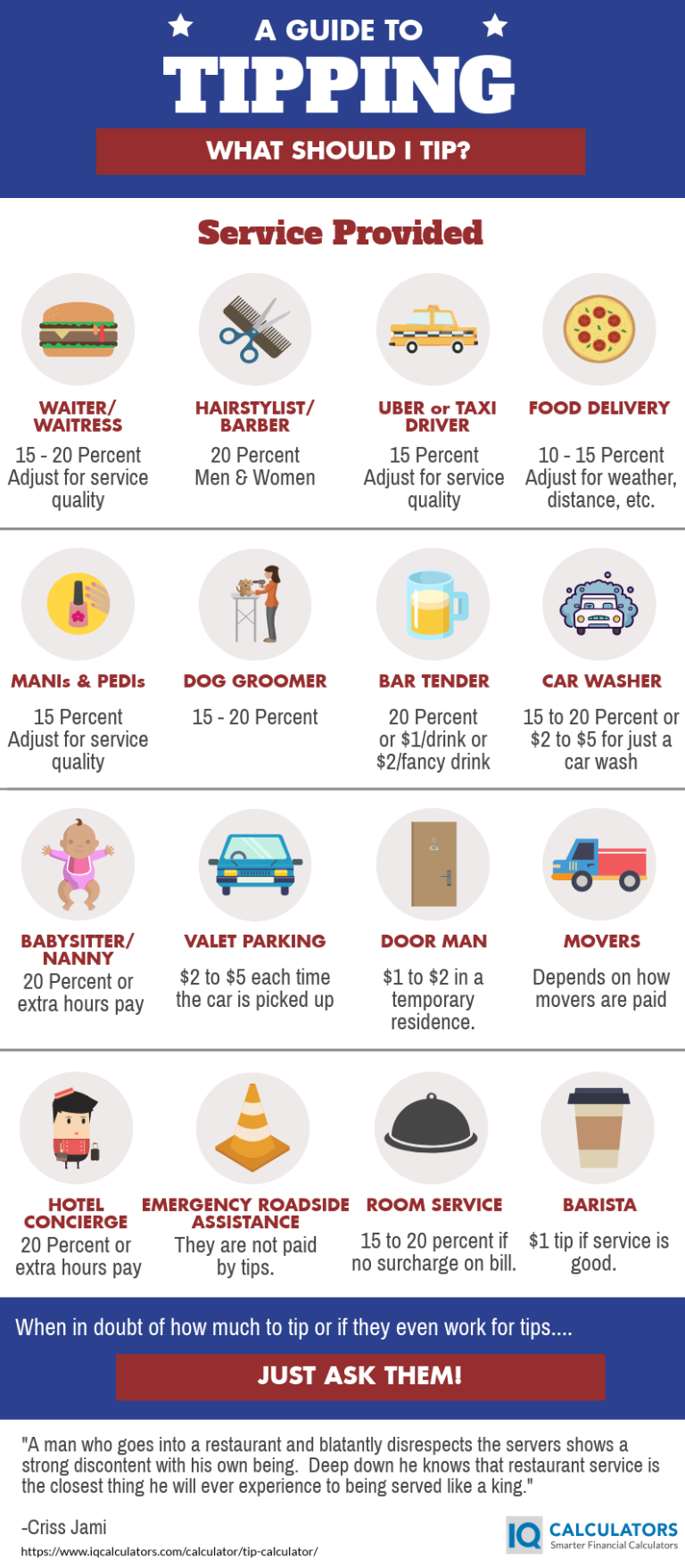

In the US a tip of 15 of the before tax. Calculate your sales tax rate by dividing the total amount of taxable products sold throughout the month by your sales tax rate. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Is food taxable in Pennsylvania. Cigarette tax is calculated by multiplying. Base state sales tax rate 6.

Enter your info to see. For example if your tax rate is 10 and you sold. There are three steps in calculating tax payments and total amounts due on cigarette and little cigar purchases.

If you make 70000 a year living in the region of Pennsylvania USA you will be taxed 10536. Average Local State Sales Tax. Pennsylvania Paycheck Calculator - SmartAsset.

Due to varying local sales tax rates we strongly. You are able to use our Pennsylvania State Tax Calculator to calculate your total tax costs in the tax year 202223. And all states differ.

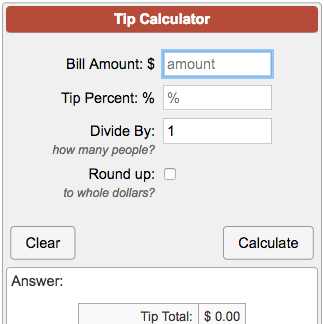

Local rate range 020. How Income Taxes Are Calculated First we. The Tip Calculator calculates tip amount for various percentages of the cost of the service and also provides a total amount that includes the tip.

Pennsylvania Income Tax Calculator 2021. Use ADPs Pennsylvania Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Pennsylvania state sales tax rate range.

Medicare Tax is 145 of each employees taxable wages until they have earned 200000 in a given calendar year. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. This isnt an official tool of the Pennsylvania.

By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia.

How To Calculate Sales Tax In Excel

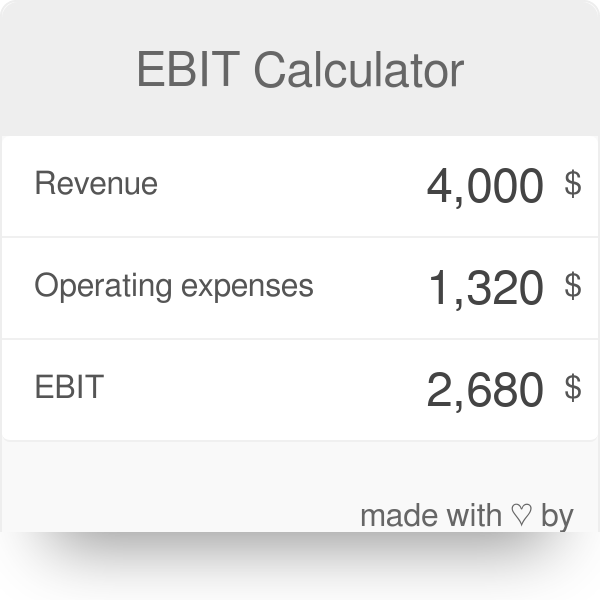

Ebit Calculator Earnings Before Interest And Taxes

How To Calculate Sales Tax In Excel Tutorial Youtube

Tip Calculator Free Tip Calculator App

How To Calculate Sales Tax In Excel

How To Charge Your Customers The Correct Sales Tax Rates

Dillons Food Stores Monroe 8130x Heavy Duty Printing Calculator For Accounting And Purchasing Professionals 1 In 2022 Prints Addition And Subtraction Multiplication And Division

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Business Start Up Costs Spreadsheet Startup Business Plan Template Startup Business Plan Financial Plan Template

How To Calculate Sales Tax Definition Formula Example

Sales Tax On Grocery Items Taxjar

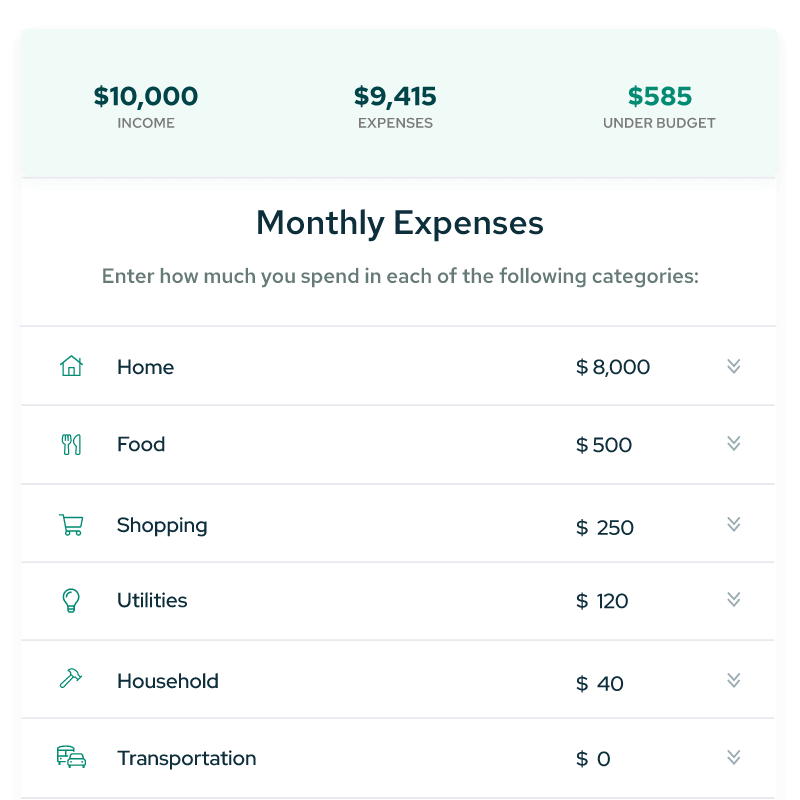

Monthly Budget Calculator Analyze Your Spending In Minutes Savology